🗞 The State of Early Stage Fundraising

Plus a quick Hawk Hill update!

A quick update: We closed our first SPV this past week, a major milestone for Hawk Hill Ventures! Our strategy is simple: bet on great founders early, usually as one of the first checks, and then double down in their next round. If you’re interested in receiving information about our future investments, please send an email to team@hawkhill.ventures to get in touch.

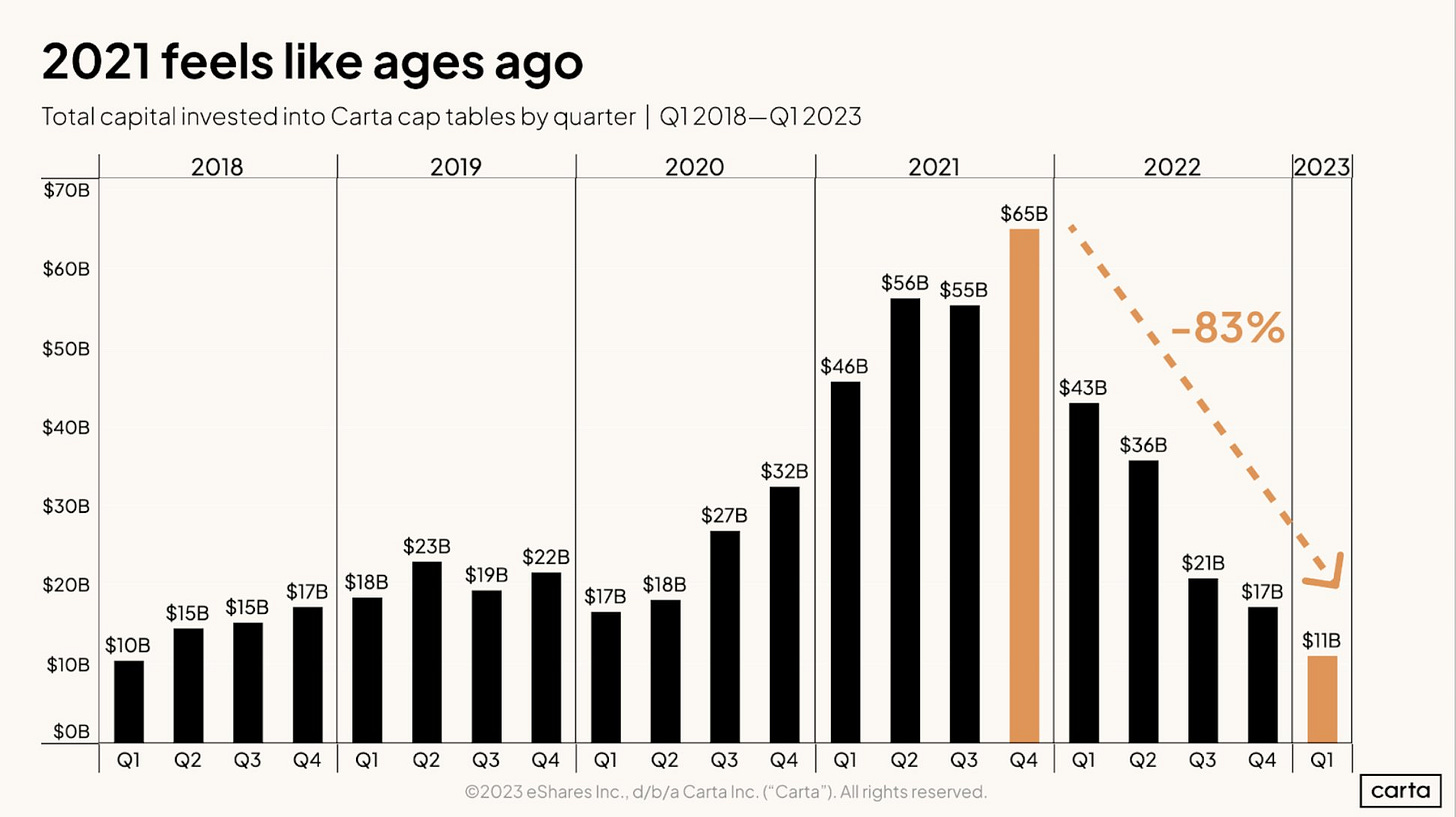

When founders go out to raise, they often ask, "What's the market like right now?" It's so hard to answer this without the right data. Last week at SF Tech Week, Carta held a great panel with everything you need to know. Read on for the highlights, and the full presentation is available here.

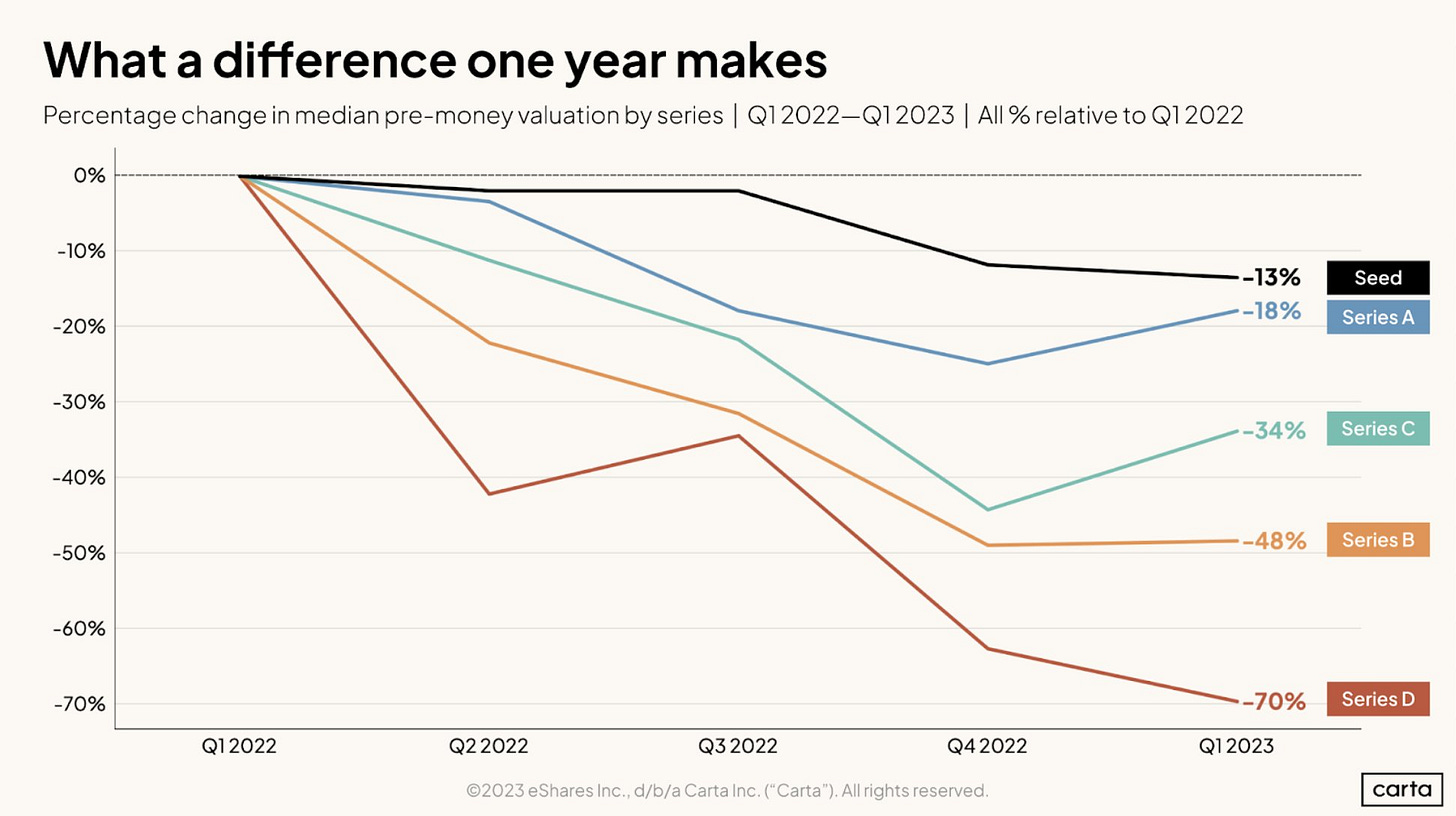

Valuations are down, but early stage is the least impacted. We've seen this first hand. The average YC seed round in the last batch was $2m raised on on $20m post. (Source)

If you're raising a round, plan your burn accordingly. Getting to "default alive" (as Paul Graham says) will give you the leverage you need when planning your next fundraise.

It's true that valuations are tied to how much you raise. I often advise founders to ask themselves: "How much do I need to get to the next stage?" Then work backwards from that to your valuation. Dilution will adjust accordingly.

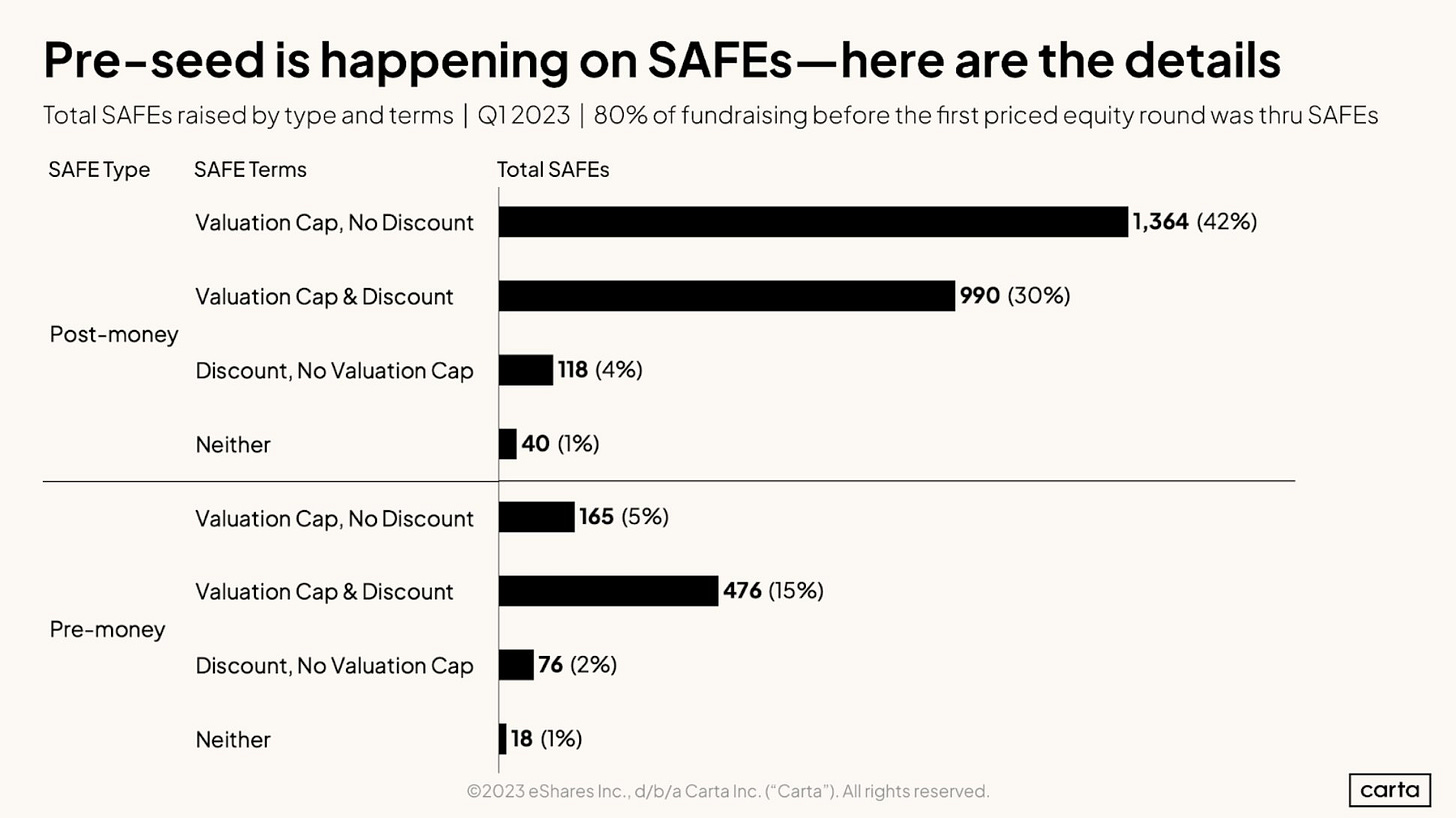

We advocate for founder-friendly terms. For us, this means: capped, post money safe with no discount, no pro-rata, and no side letter. Beware of non-standard terms like MFN provisions or guaranteed board seats, especially at the earliest stages.

In the end, the most important thing to remember is that fundraising is in service of your mission. As much as you can, remain focused on what you're building and ruthlessly prioritize making your startup better every day.

What’s your advice for coming trying to raise right now?

Wait it out or continue the road show?