💡Perfect Ideas vs Perfect Opportunities

An opportunity in the hand is worth twenty ideas in the bush

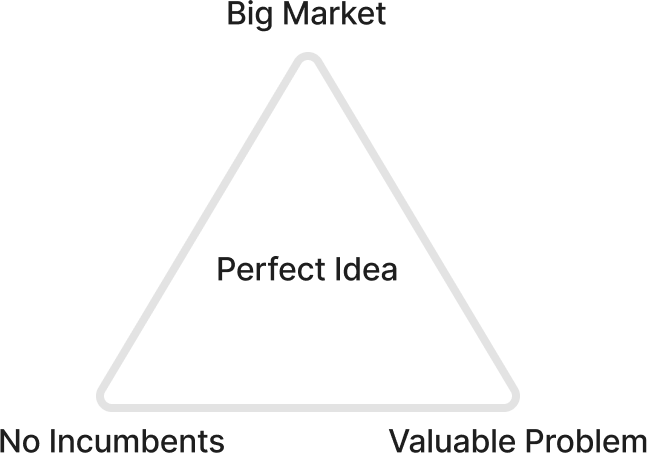

There are no perfect startup ideas. I wish I could drill that into the brains of founders who waste time searching for an idea that checks all the boxes on day one.

I don’t blame them. Pivoting is hell, and it’s better to avoid wasting time on an idea that’s flawed from the beginning.

However, our world is full of live players and markets are efficient, which means it’s exceedingly rare for a perfect idea to exist, unexploited. If you’re going to build a business, you’ll have to take some risks. You shouldn’t be looking for the perfect idea, but the perfect opportunity.

A perfect opportunity is a riskier version of the perfect idea. The market is promising, but not yet validated. There are other players, but nobody is winning. And most importantly, the solution is defensible in some way.

Markets make or break companies. In Brett’s words, “some markets are far more fertile than others. An ideal market is one that has enough buyers with an urgent problem to drive significant initial revenue, but ideally not enough that it's a saturated market.” Identifying fertile markets requires vision and unique insight. You have to see how the world is going to change, and you have to be early. This often is a contrarian take! If VCs are doubting your market size, you’re on the right track.

A defensible solution is the second most important. When building a company, defensibility justifies investment. Easily replicable ideas lead to weak margins. There needs to be some staying power. I often refer to the '7 Powers' framework of defensibility. Ensuring that your solution has some sort of economy of scale, network effect, or high switching costs will give your company a chance to establish an enduring business.

Finally, there needs to be some sort of existing competition. But why are founders so afraid of competition? I blame Peter Thiel and his book Zero to One. This startup gospel has been repeatedly misinterpreted by founders everywhere. He preaches that creating a new market is better than competing in an existing one. Often, people believe that the mere existence of competition makes a market less compelling, when in fact, it’s a sign of opportunity. Existing competitors offer market validation, especially when they aren’t executing to the fullest of their ability. Some of my biggest customers have come from the public logos of our biggest competitors.

Investors often say that great founders have “vision.” But what does that really mean? To me, it’s the ability to look at an almost-right idea, and frame it as the perfect opportunity for innovation. This vision isn't just seeing things as they are, but as they could be, turning the overlooked into the highly sought after. Successful early-stage founders need to prove that they can bridge the gap from perfect opportunity to perfect idea. So, stop searching for perfection, and start seeking opportunities where others see none.

Subscribed! I might incorporate this in my post here (summarized 50+ articles on the topic of startup ideas): https://scalingknowledge.substack.com/p/startup-ideas-exploration-and-evaluation