🏦 BNPL: Pouring salt in the wounds

Buy now pay later isn't a new idea

If someone said “why don’t we offer the average person unsecured debt to buy whatever they’d like,” what would you say? Personally, I think I would say you were insane and never think about it again. You know what sounds way better but actually just means the same thing? “Imagine a new payments network that didn’t rely on the antiquated credit system.”

Buy now pay later (BNPL) is not a new thing. Its origins can be traced to the 1800s with the invention of installment plans. However, BNPL has been made accessible to the masses with firms like AfterPay, Affirm, Klarna and more. Now, there is merit to more equitable access to credit. Max Levchin credits that mission to much of Affirms foundation and I won’t dispute that. Nonetheless, it has gone too far.

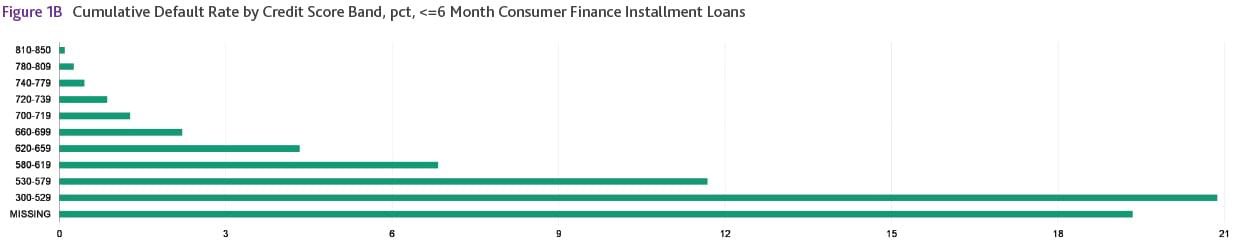

If we take a look at a Moody’s Analytics from June 2022 titled “Buy now, pay later…hopefully,” we can see that “credit scores under 620 account for over half of the debt for this product. In contrast, credit scores above 700 account for less than 5%.” More than a third of BNPL borrows have missed at least one payment.

In late fall/early winter of 2022, it became clear that delinquencies were rising as the economy was struggling. It has never been easier to borrow money to buy shoes, clothing, some random gadget and pay your installments on a credit card which you are late on…which then leads to 20% interest on your credit card debt on top of the interest on your BNPL debt. Forbes referred to this as “loan stacking.” There is an argument to be made that if a consumer wants to take these risks, they are more than welcome to. However, I personally have my own moral issues with services that make it so easy to dig a deep hole you can never climb out of. That is why I don’t support Robinhood (different can of worms, sorry!).

This year, Affirm stock has gotten crushed (under $15 from a high of $140) and justifiably so as losses widen. To be fair though, Affirm IPO’d for over 40x sales which never made sense. AfterPay was purchased by Block for over 40x sales too. At one point, Klarna was valued at over 50x sales. 50! In 2021, BNPL really had its moment in the sun. The broader fintech ecosystem saw multiples of about half the BNPL peer group. I’m not sure where everyone missed that these companies are basically just riskier payment processors. They charge the merchant a borderline predatory transaction fee, a bit of interchange and late fees…when defaults go up, losses fly.

None of what I’m saying is new and I’m pretty much just pouring salt in the wounds at this point, but the fact remains: unsecured debt is unsecured debt and it will either get more expensive to justify the losses or it will get much, much less popular.

Food for thought: I always wondered if one of these companies was teetering on the edge of bankruptcy, should you just go on a shopping spree and only pay installment one (I know why that is dumb…)?

George this is great! Can you tell us more about what you recommend the solution is? So we need more regulation on consumers taking on debt? Should we limit certain operations within BNPL companies? How did we find a balance between regulation to protecting consumers & giving them free will - free choice. One would argue, this is America, give the people what they want!